💱Currency Exchange

Finding the best exchange rates and avoiding costly tourist traps

Finding the best exchange rates and avoiding costly tourist traps

Walk through Bangkok's Suvarnabhumi Airport and the first thing you'll see after immigration is a row of gleaming currency exchange booths. The rates displayed look reasonable enough—maybe 32.0 baht per US dollar. But these arrivals-level bank counters are the worst option. Take the elevator down to B floor (Airport Rail Link level) where independent money changers including Super Rich 1965 offer rates close to downtown—around 32.4 baht. Or skip the airport entirely and head to a Super Rich branch in the city center for the best rate of 32.5 baht. On a $5,000 exchange, the difference between the arrivals-level counters and city-center Super Rich costs you about $75—real money in Thailand.

Currency exchange in Thailand operates on a simple principle: the more convenient the location, the worse the rate. Thailand's central bank publishes daily reference rates, but individual exchangers set their own spreads. Understanding this system—knowing where to go, what to bring, and how to time your exchanges—makes a tangible difference to your budget, especially if you're moving significant amounts or settling in Thailand long-term.

What took me months to learn is that Thailand's currency exchange landscape is surprisingly transparent once you know the players. There's no hidden club, no secret handshake. The best rates are available to everyone, sitting in plain sight in busy commercial districts. You just need to know where to look and what to avoid.

"On a $5,000 exchange, the difference between arrivals-level airport counters and Super Rich can cost you around $100—enough for several excellent meals or a weekend getaway."

Anyone who's spent time in Thailand's expat circles has heard the name whispered with reverence: Super Rich. But here's where it gets confusing—there are actually two completely separate companies: Super Rich Thailand (green logo) and Super Rich 1965 (orange logo). They're competitors, not branches, though their rates are usually very close to one another. Both consistently offer the best retail exchange rates in the country, and both have earned their reputations through decades of reliability.

The flagship Super Rich branches cluster around Bangkok's Chidlom and Ratchaprasong areas—commercial zones where Thai businesspeople and tourists alike need to move money quickly. The green Super Rich Thailand headquarters sits at Ratchaprasong on Ratchadamri Road, a short walk from CentralWorld shopping mall. The orange Super Rich 1965 has its head office on Silom Road, with a main branch on Rajdamri Soi 2, also near CentralWorld. Neither location is particularly glamorous. Both can have lines stretching out the door during busy periods.

But the rates justify the inconvenience. When I checked rates on a random Tuesday, Super Rich offered 32.5 baht per US dollar. The Suvarnabhumi arrivals-level booth? 31.8. Bangkok Bank? 32.0. My hotel's exchange service? 31.5. The math becomes painful when you're exchanging serious money. That $5,000 becomes 162,500 baht at Super Rich versus 159,000 at arrivals-level counters—a 3,500 baht difference. That's not trivial money in Thailand; it's several nice dinners or a weekend trip to nearby provinces.

Super Rich Thailand (green): Flagship at Ratchaprasong/Ratchadamri (near CentralWorld). Branches citywide including Chidlom BTS, Asoke BTS, Central Pattaya, and inside several Bangkok shopping malls. Check their website for current branch locations and daily rates.

Super Rich 1965 (orange): Head office on Silom Road; main branch on Rajdamri Soi 2 near CentralWorld. Also at Suvarnabhumi Airport B floor and rail-network kiosks. Operates across Bangkok but does not have Chiang Mai or Pattaya branches. Note: Chiang Mai's "Super Rich" outlets are independent businesses, not part of the Bangkok chains. Rates posted online daily.

Pro tip: Both companies post live rates on their websites. Check before you go—if rates are particularly favorable, exchange more; if they've dropped, consider waiting a day or two if your timeline allows.

Super Rich dominates Bangkok, but there are other competitive players worth knowing. Vasu Exchange is a Bangkok exchanger near Nana BTS with rates that often match or come within a few stotang (Thai cents) of Super Rich. Independent exchange booths in tourist areas like Sukhumvit or Silom can surprise you with competitive rates—though always check the displayed rates carefully before handing over your cash.

In Chiang Mai, the exchange booth landscape differs slightly. While you'll see "Super Rich" branded outlets, these are independent businesses not affiliated with the Bangkok chains. Local competitors like TT Currency Exchange and several independent booths near Tha Pae Gate and Nimmanhaemin Road offer rates nearly as good as Bangkok's best. In smaller cities and beach destinations, options narrow and rates worsen, though they're still typically better than what you'd find at Bangkok's arrivals-level airport counters.

One strategy I've seen work well: if you're arriving in Bangkok before heading elsewhere in Thailand, exchange enough cash to cover your first weeks or months at a Super Rich branch before you leave the capital. The 0.5-1 baht per dollar difference compared to provincial rates adds up. Just be mindful of carrying large amounts of cash—use hotel safes and split your funds across multiple secure locations if you're moving significant sums.

→ Location overhead: Airport and hotel locations pay premium rent, passing costs to customers

→ Volume: High-volume booths like Super Rich operate on thin margins, making profit through quantity

→ Bill condition: Crisp, new bills command better rates than worn ones; some places refuse damaged bills entirely

→ Denomination: Large bills (100 USD/EUR, 50 GBP) consistently get better rates than small denominations

→ Currency: Major currencies (USD, EUR, GBP, JPY) have tighter spreads than minor ones

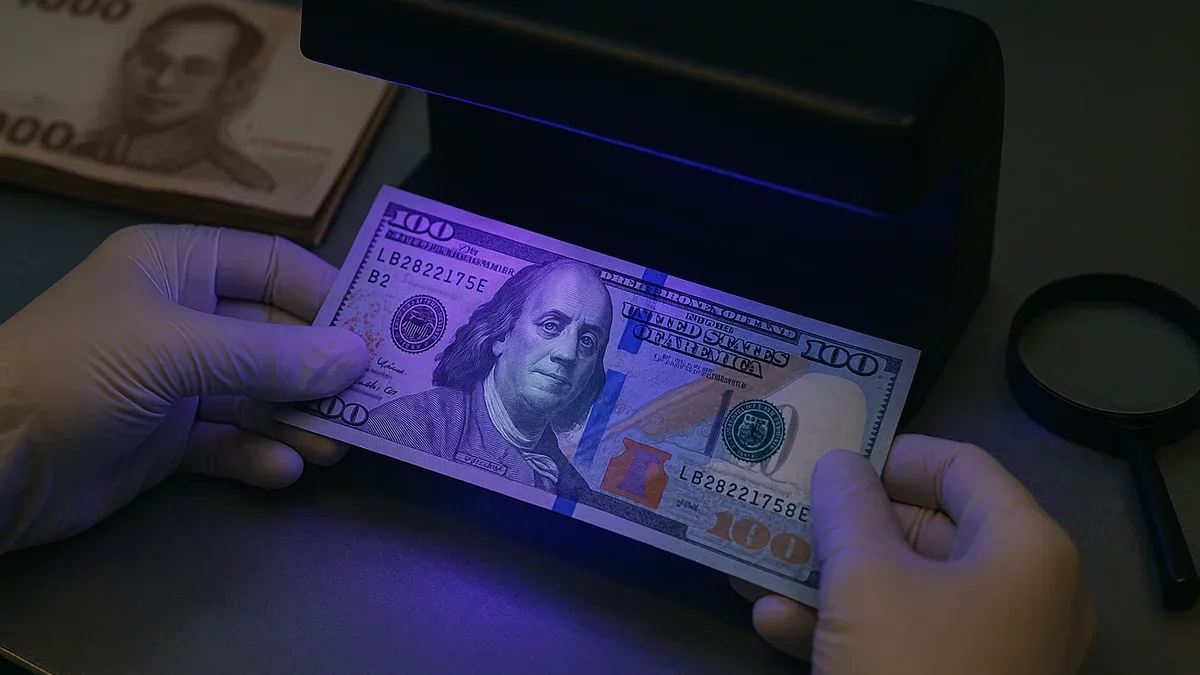

Here's something nobody tells you until you're standing at an exchange counter watching your rate drop: the physical condition and series of your bills significantly affects what you'll receive. Thai exchange booths are meticulous about accepting only pristine, recent-series currency. That crumpled $100 bill from 2006 with a small tear? Refused outright. Those $20 bills with pen marks and creases? Lower rate—sometimes substantially lower.

Before leaving your home country, specifically request new, crisp bills from your bank. Bring clean, recent-design bills—visibly marked, torn, or older-design notes may be refused outright or fetch punitive rates. The bills should be uncreased, unstained, and definitely not taped or torn. I learned this the expensive way when an exchange clerk refused three of my five $100 bills, forcing me to accept a significantly worse bank rate for those particular notes.

Denomination matters too. A $100 bill reliably gets better rates than five $20s, which get better rates than twenty $5s. The posted "buy" rate you see on exchange booth boards? That's typically for $100 bills. Smaller denominations often receive rates 0.2-0.5 baht worse per dollar. On a $1,000 exchange in $20 bills versus $100 bills, you might lose 300-500 baht to denomination penalty alone.

The perennial question: should you use ATMs or exchange booths? The honest answer is: it depends on your specific financial situation and how much you're withdrawing. Most Thai ATMs now charge around 250 baht per foreign withdrawal (about $7.50), regardless of amount, though AEON ATMs offer a lower 150 baht fee. Typical per-withdrawal caps are 20,000-30,000 baht (some banks like Kasikorn allow 30,000 per transaction). Your home bank likely adds its own international withdrawal fee plus a foreign transaction fee. Combined, you might pay $10-15 per withdrawal. Always decline dynamic currency conversion ("with conversion") at ATMs.

But here's the twist: if your bank offers genuinely favorable exchange rates (some do), the overall cost might still beat carrying and exchanging physical cash, especially for smaller amounts. I have a US bank account that charges no foreign transaction fees and uses interbank rates. For me, withdrawing 20,000 baht (around $615) from an AEON ATM costs only the 150 baht Thai ATM fee—roughly 0.25% total cost. That beats the spread at mediocre exchange booths, though not at Super Rich.

The calculus shifts for larger amounts. Most Thai ATMs cap withdrawals at 20,000-30,000 baht per transaction. Withdrawing 100,000 baht means 4-5 separate transactions at 250 baht each—1,250 baht in Thai bank fees before your home bank adds its charges. Suddenly, flying into Bangkok with $3,000 in crisp hundreds and hitting a Super Rich booth makes financial sense, saving several thousand baht compared to ATM withdrawals. For more on managing your Thai banking needs, see our comprehensive guide.

For amounts under $500: ATMs with a no-foreign-fee bank card often win on convenience and total cost. The 250 baht fee (or 150 baht at AEON) is annoying but manageable.

For amounts $500-$2,000: Good exchange booths typically beat ATMs. The savings on exchange rate spreads outweigh the hassle of carrying cash.

For amounts over $2,000: Super Rich or equivalent top-tier booths are definitively cheaper. The rate difference becomes substantial.

For ongoing monthly expenses: Consider opening a Thai bank account and using Wise or similar services for periodic transfers. The exchange rates beat almost everything, though transfer delays (1-2 days) mean you need to plan ahead.

Let's be direct about where you'll get fleeced. At Suvarnabhumi, the arrivals-level bank counters have notably poor rates—avoid them. However, if you need airport convenience, ride the elevator down to B floor (Airport Rail Link level) where there's an "Exchange Zone" with SuperRich 1965 and other private changers whose rates are close to downtown and far better than the arrivals-level banks. Hotel exchange services typically offer rates 3-5% below market. Credit card cash advances combine poor exchange rates with brutal cash advance fees and immediate interest accrual—possibly the most expensive option available.

Thai banks, surprisingly, are also mediocre for cash exchange. Their rates typically fall somewhere between airport booths and decent independent exchangers—better than the worst options but significantly worse than Super Rich or Vasu. If you have a Thai bank account, you're much better off using international wire transfers or Wise to move money in rather than walking into a branch with physical currency.

One particularly insidious trap: exchange booths in prime tourist locations like Khao San Road or beachfront Phuket sometimes advertise "no commission" while quietly offering rates 2-3% worse than Super Rich. "No commission" is meaningless when the rate itself is the scam. Always check the buy/sell rates displayed prominently—that's where the real cost hides.

Booth won't show rates until you hand over money: Walk away immediately. Legitimate booths display rates prominently.

Clerk uses calculator to "show" the rate: They're likely applying hidden fees or worse math than displayed rates suggest.

"Special rate just for you": There are no special rates. If someone's offering you something unusually good, it's a setup for a scam—either counterfeit baht or a sleight-of-hand short-change. Stick to established, branded booths.

After years of exchanging currency in Thailand, here's what actually works. First, bring most of your initial funds in physical cash if you're moving significant amounts—$2,000-5,000 in crisp, large denomination bills. Yes, it feels uncomfortable carrying that much, but the savings justify the brief discomfort. Use hotel safes religiously and split funds across multiple secure locations.

Second, exchange immediately upon arriving in Bangkok, before heading to your final destination. Take a taxi from the airport straight to the Super Rich at Ratchaprasong (around 350-600 baht including surcharge and tolls). The taxi fare pays for itself in better rates compared to provincial options. Alternatively, use the B floor exchange zone at the airport for nearly-as-good rates if you're in a hurry. Exchange what you need for the next month or two, stash it securely, and you're done.

Third, once settled in Thailand, set up the infrastructure for cheaper long-term transfers. Open a Thai bank account (requires appropriate visa), get a Wise account, and periodically transfer funds at near-interbank rates. The 1-2 day transfer time is no problem when you're planning ahead. This hybrid approach—physical cash for initial settling, electronic transfers for ongoing needs—optimizes both cost and convenience.

Fourth, never exchange Thai baht back to foreign currency when leaving Thailand. The reverse exchange rates are punitive—often 5-8% worse than the buying rate. Just spend your remaining baht on last-minute shopping, airport meals, or save it for your next visit. If you somehow end up with substantial baht you can't spend, eat the loss on reverse exchange rather than carrying baht indefinitely. But with proper planning, this shouldn't happen.

Currency exchange in Thailand rewards the informed and punishes the careless. The system isn't complex—it's just that nobody explains it upfront. Treat your first exchange as a learning experience, memorize where Super Rich locations are, keep your bills pristine, and you'll consistently get rates 5-8% better than tourists wandering into the first booth they see. On the scale of years and tens of thousands of dollars, that difference compounds into genuinely meaningful money—money better spent experiencing Thailand than evaporating into exchange spreads. For more practical tips on settling into Thai life, explore our practical services guides.

BEST RATES

Super Rich (Orange/Green)

Consistently best retail rates

Multiple Bangkok locations

Vasu Exchange

Competitive alternative

Bangkok (Nana BTS)

AVOID

Airport Arrivals-Level Banks

Poor rates (use B floor instead)

Hotels

3-5% worse rates

Credit Card Advances

Worst option available

REQUIREMENTS

Super Rich

Best retail rate

32.5 THB/USD

Airport B Floor

Good airport option

32.4 THB/USD

Thai Bank

Mediocre rate

32.0 THB/USD

Airport Arrivals

Poor rate

31.8 THB/USD

Example rates reflecting Nov 2025 conditions. Always check current rates before exchanging.