🏠TM30 Notification

Residence notification for foreigners staying in Thailand

Residence notification for foreigners staying in Thailand

You're at immigration applying for a Certificate of Residence so you can finally get that Thai driver's license, and the officer asks for your TM30. You stare blankly. TM30? You've never heard of it. Your landlord never mentioned it. Nobody at your company's HR department said anything about a TM30. The officer shakes their head—without a TM30 receipt, no certificate. You walk out confused, frustrated, and wondering why Thailand's immigration system includes requirements nobody tells you about until you need them.

The TM30—formally the "Notification of Residence of Foreigners"—is one of Thailand's most universally applicable yet widely misunderstood immigration requirements. In theory, it's simple: when a foreigner stays at any property in Thailand, the property owner must notify Thai Immigration within 24 hours. In practice, it's a bureaucratic maze where responsibility is unclear, enforcement is inconsistent, and many foreigners only discover it exists when they need immigration services that require it.

Unlike the 90-day report, which foreigners file themselves, the TM30 is legally the landlord's or property owner's responsibility. Legally—but not always practically. Many Thai landlords, especially those renting to foreigners for the first time, don't know about TM30 requirements. Others know but consider it an unnecessary hassle. Hotels and serviced apartments file automatically for guests, but private condo rentals and house leases? That's where things get complicated, leaving many expats stuck between Thai law saying their landlord should file and practical reality where landlords won't or don't.

"The TM30 isn't about tracking your movements—immigration already has that through entry stamps. It's about establishing your current registered address, a piece of paper you'll need for services ranging from work permits to motorcycle licenses."

Thai law is clear: the property owner, manager, or possessor of the dwelling must file the TM30. Not the foreigner staying there—the person who owns or controls the property. This makes sense for hotels and guesthouses, which routinely file TM30s for every guest automatically. Check into any registered hotel in Thailand, and the TM30 is filed as part of their standard check-in process. You don't see it, you don't think about it, it's handled.

But private rentals are different. Your Thai landlord renting out their condo is legally required to file a TM30 within 24 hours of you moving in or any time you actually change addresses. Since the June 30, 2020 notification from the Royal Thai Police, they no longer need to resubmit a TM30 every single time you leave and return to the same address within the stay window declared on the last filing. That nuance is lost on many landlords, so you may still have to educate them—and verify after long trips that the existing TM30 record still covers you before you attempt immigration errands.

The frustrating reality is that while landlords are legally responsible, foreigners bear the practical consequences. Immigration won't give you a Certificate of Residence without a TM30. Your 90-day report might be rejected without a current TM30 on file. Visa extension applications can hit delays if your TM30 isn't updated. The landlord might face a 2,000 baht fine if caught, but you're the one stuck unable to complete immigration processes.

As of May 7, 2025 that reality got sharper: the BOI Single Window now requires a TM30 acknowledgment before certain long-stay visa filings move forward, and agencies such as the Department of Land Transport routinely ask to see TM30 receipts when you apply for a Certificate of Residence to get a Thai driver's license. Translation: even if the fine targets the owner, you must proactively confirm the record exists before important appointments.

Legally, a TM30 must be filed within 24 hours when a foreigner first arrives at a residence or whenever they move to a different address. The 2020 easing clarified that if the foreigner leaves and comes back to the same premises within the stay period declared on the last TM30, the owner does not have to re-file again. Think of it like checking in to a hotel: the TM30 covers you for that declared stay until you actually relocate.

Domestic travel now sits in a gray zone. Some immigration offices are satisfied once you’ve filed for your primary address and keep the receipt handy. Others still want confirmation when you return from long trips, so it’s smart to email or revisit the online portal to make sure your stay dates still align, especially if you extended your travel beyond what the last TM30 declared. Always ask your local immigration office what they expect so you’re not surprised.

What still resets everything is a genuine change of address. Move condos, spend months at a second home upcountry, or switch to a long hotel stay? File a fresh TM30 for that new property within 24 hours of arrival. Likewise, if you told immigration you’d check out on June 1 but re-entered Thailand on August 1 to stay longer, submit a new TM30 so the system reflects your current stay period before you try anything like a visa extension or BOI filing.

Legally required: File within 24 hours of a foreigner arriving to a property or shifting to a different address. That clock starts the moment they physically sleep there.

2020 easing: Returns to the same address within the previously declared stay period do not require a brand-new TM30, but keep the original receipt handy in case officers ask.

Realistic approach: Refile immediately when you move, update the entry if your stated checkout date passes, and confirm local expectations after long trips so you’re never scrambling in an immigration waiting room.

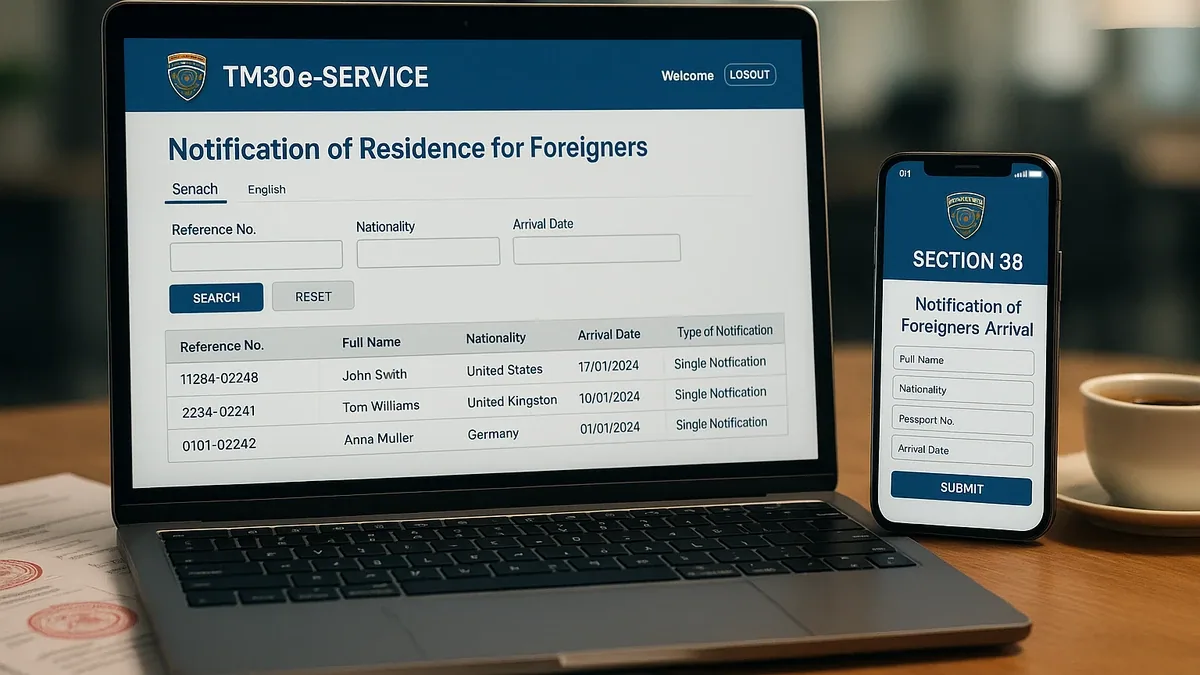

Thai Immigration's online TM30 system is one of their better digital implementations, which is damning with faint praise but genuinely useful once you navigate initial setup. The system allows property owners (or foreigners acting on their behalf) to file TM30 notifications without visiting immigration offices, receiving instant confirmation receipts that are legally valid for all immigration purposes.

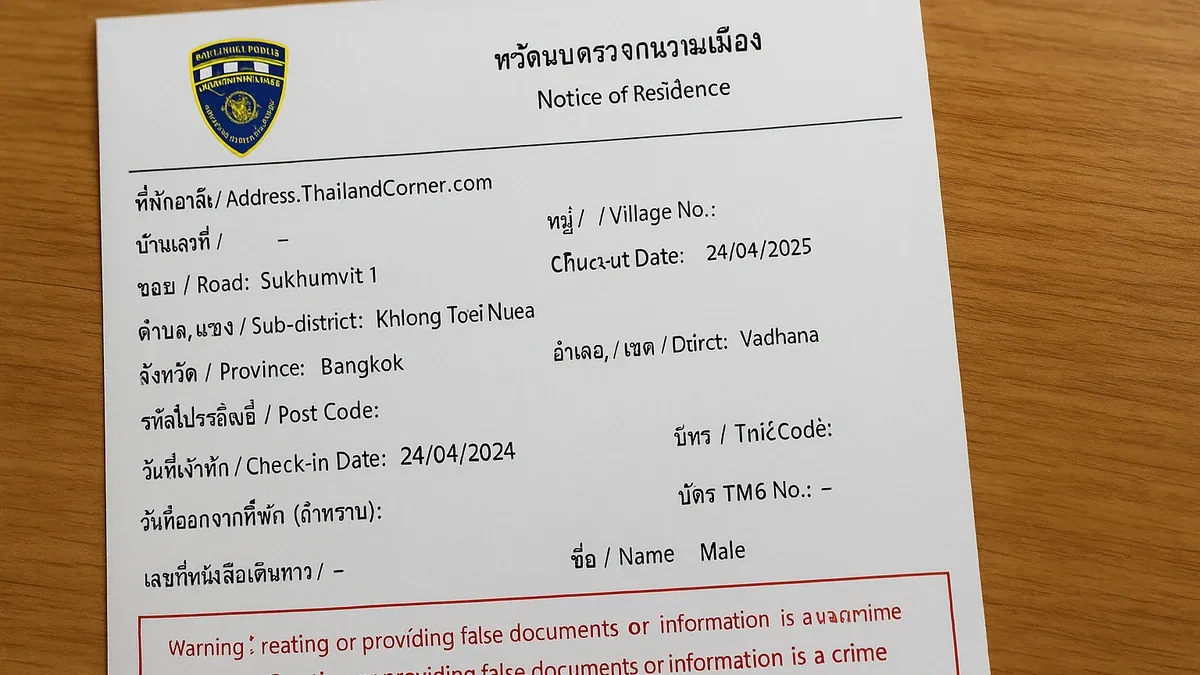

Setting up the account requires the property's house registration book (Tabian Baan) details—a document your landlord has that shows property ownership and registration information. You'll input the property address, registration number, and owner information once during initial setup. After that, adding new TM30 notifications for foreigners staying at the property takes just minutes: enter passport details, upload document scans, submit. The system generates a confirmation slip immediately, which you should save digitally and print for your records.

The common failure point is landlords who won't provide house registration book information or won't set up the online account. If your landlord is uncooperative, you have options. Some immigration offices allow foreigners to file TM30 in person using photocopies of the rental contract and house book, essentially filing on the landlord's behalf. Others want written authorization from the property owner. The policies aren't uniform, but most offices recognize the practical problem and offer workarounds for foreigners stuck with unhelpful landlords.

→ All registered hotels, guesthouses, and serviced apartments automatically file TM30 for guests during check-in. You won't see the process happen, but it's handled.

→ Those receipts simply prove where you're sleeping that week, which can help if an officer informally asks, but TM8 re-entry permits officially require only the passport, TM8 form, photo, and fee.

→ For services requiring proof of long-term residence (Certificates of Residence, work permits, etc.), hotel TM30s usually don't suffice. You need a TM30 from your permanent address.

→ Moving between hotels while traveling doesn't require new TM30 filings from you—each hotel files for their own property when you check in.

The penalty for not filing TM30 is technically a fine up to 2,000 baht imposed on the property owner. In practice, many property owners go years without filing and never face consequences because immigration doesn't actively hunt for violations—they discover them when foreigners need services and can't provide TM30 receipts. At that point, the landlord might get fined if immigration is strict, but more commonly, they're just told to file it retroactively.

For foreigners, the lack of TM30 creates practical problems rather than legal penalties. Without a current TM30 receipt, you cannot obtain a Certificate of Residence, which you need for driver's licenses, bank account openings, and various other services. Your 90-day report filing might be rejected if the system can't verify your registered address through TM30 records. Visa extension applications can face delays while immigration sorts out your address registration status.

The frustrating aspect is discovering these problems only when you need immigration services urgently. You're at immigration for a visa extension that expires in three days, and they inform you your TM30 isn't filed or isn't current. Now you must get your landlord to file it, wait for confirmation, then return to immigration—eating into your deadline and creating unnecessary stress. This is why proactive TM30 management matters: not because immigration actively enforces it, but because its absence blocks services you'll eventually need.

If your landlord refuses to file TM30 or claims ignorance, you're not helpless. The first approach is education—explain that it's a legal requirement affecting your ability to complete immigration procedures. Show them the immigration website. Emphasize that filing takes 10 minutes online and is free. Many landlords simply don't understand the requirement and become cooperative once informed.

If education fails, offer to handle it yourself. Ask for copies of the house registration book and property owner's ID, then file online or in person on their behalf. Many landlords are fine with this approach—they're not opposed to TM30, they just don't want to deal with bureaucracy themselves. Immigration offices have seen this scenario countless times and generally accept foreigner-filed TM30s as long as property documents are provided.

In extreme cases where landlords are completely uncooperative, some expats have successfully filed TM30s using just their rental contract and photocopy of the house book, explaining the situation to sympathetic immigration officers. Policies vary by office, but most recognize that foreigners shouldn't be punished for landlord non-compliance. The worst case is usually that you need to change accommodations to a landlord who understands immigration requirements—a hassle, but sometimes necessary for long-term peace of mind.

File new TM30 at the new property within 24 hours. Your old TM30 automatically becomes invalid once you're registered elsewhere. The new TM30 becomes your current address of record for all immigration purposes.

Technically requires TM30 at each location, but enforcement is inconsistent. Hotels file automatically. Private stays with friends or family should technically be filed but often aren't unless you're staying long-term.

If you regularly alternate between two properties (Bangkok during the week, Hua Hin on weekends), file TM30 at both properties. Update whenever you move between them if your local immigration office enforces domestic travel TM30 requirements.

The TM30 is a remnant of older immigration tracking systems designed when governments needed manual notification of foreign residents' locations. Before digitized borders and computerized visa systems, the TM30 served as the primary method for knowing where foreigners lived in Thailand. Property owners would file notification, immigration would maintain paper records, and authorities had a system for locating foreigners if needed.

In 2025, this justification is largely obsolete. Immigration knows when you enter and exit Thailand through passport stamps. They know your visa type and expiration. They have your contact information from visa applications. The TM30 adds little meaningful information they don't already possess through other systems. But changing immigration law requires legislative action, and removing an existing requirement is bureaucratically and politically complicated even when the requirement no longer serves its original purpose.

So the TM30 persists, transformed from a tracking tool into a bureaucratic checkbox—a document you need not because immigration learns anything from it, but because their systems require it before processing certain services. It's frustrating precisely because it lacks obvious purpose, yet remains mandatory. Understanding this helps contextualize the requirement: it's not security theater or deliberate harassment, just bureaucratic inertia, a system that continues existing because removing it would require more effort than maintaining it.

If you own your property as a foreigner (through condominium ownership in your name), you're both the property owner responsible for filing TM30 and the foreigner who needs TM30 filed. You must file TM30 for yourself using your property's house registration book and your passport details.

This seems absurd—notifying immigration that you live at the property you own—but the system doesn't distinguish. Set up online TM30 filing using your property documents and submit a new entry whenever you move, extend a stay beyond what you previously declared, or add long-term guests. For more on property ownership as a foreigner, see our comprehensive guide.

The expats who never have TM30 problems are the ones who address it proactively during move-in and anytime they change addresses or extend a stay. When signing a rental contract, discuss TM30 requirements with your landlord immediately. Set up the online system together if they're willing, or get copies of house registration documents if you'll file yourself. Establish the process before problems arise.

After significant travel, double-check that your existing TM30 still matches reality: same address, same stay window, same passport information. If you moved, if the prior checkout date has passed, or if immigration specifically instructs you to refresh the filing, submit a new TM30 immediately. Keep a folder (physical and digital) with all TM30 confirmation receipts organized by date. Immigration officers requesting TM30 receipts want to see the most recent one, proving your current registered address. Losing receipts means visiting immigration to get reprints from their system, wasting time you could avoid with basic organization.

The TM30 is one of those Thailand requirements that seems baffling until you accept it as immutable bureaucracy and adapt accordingly. It's not going away. Immigration won't stop requiring it. Complaining about its pointlessness changes nothing. But establishing a routine—file immediately when you relocate, keep receipts organized, ensure your landlord or property manager understands the requirement—turns TM30 from a constant frustration into an occasional minor task, the kind of administrative maintenance that's annoying but manageable. For comprehensive guidance on all Thailand immigration documents, explore our visa FAQ section and learn about related requirements like the 90-day report.

DO

DON'T

Critical Timing

Must be filed within 24 hours of first arrival at a residence (or whenever you move). Hotels file automatically. Private rentals require the owner—or an authorized foreigner—to file.

Online

Instant receipt via immigration website or Section 38 app

In Person

Visit local immigration office with documents

By Post

Mail form and documents to immigration (rarely used)

Penalty

Up to 2,000 THB for late filing (landlord's responsibility)