🏧ATM Guide for Thailand

Navigating fees, limits, and the 250-baht reality

Navigating fees, limits, and the 250-baht reality

The first time I withdrew cash from a Bangkok ATM with my US debit card, the screen cheerfully informed me I’d just paid a ฿250 “transaction fee.” My bank piled on a $5 foreign ATM fee and—because it quietly marked up the exchange rate by about 3%—the ₿10,000 I pulled cost roughly $298 instead of $280. Welcome to the reality of using foreign cards at Thai ATMs.

Thailand’s ATM network is everywhere—tens of thousands of machines spanning branch vestibules, mall concourses, BTS stations, and corner 7‑Elevens. Access isn’t the challenge. Keeping your wallet from hemorrhaging flat fees and hidden FX spreads is.

Three separate charges hit most travelers:

10k

2.5% hit

20k

1.25% hit

30k

0.83% hit

(Excludes your home bank’s surcharges and FX spread, but shows why fewer, larger withdrawals tend to win.)

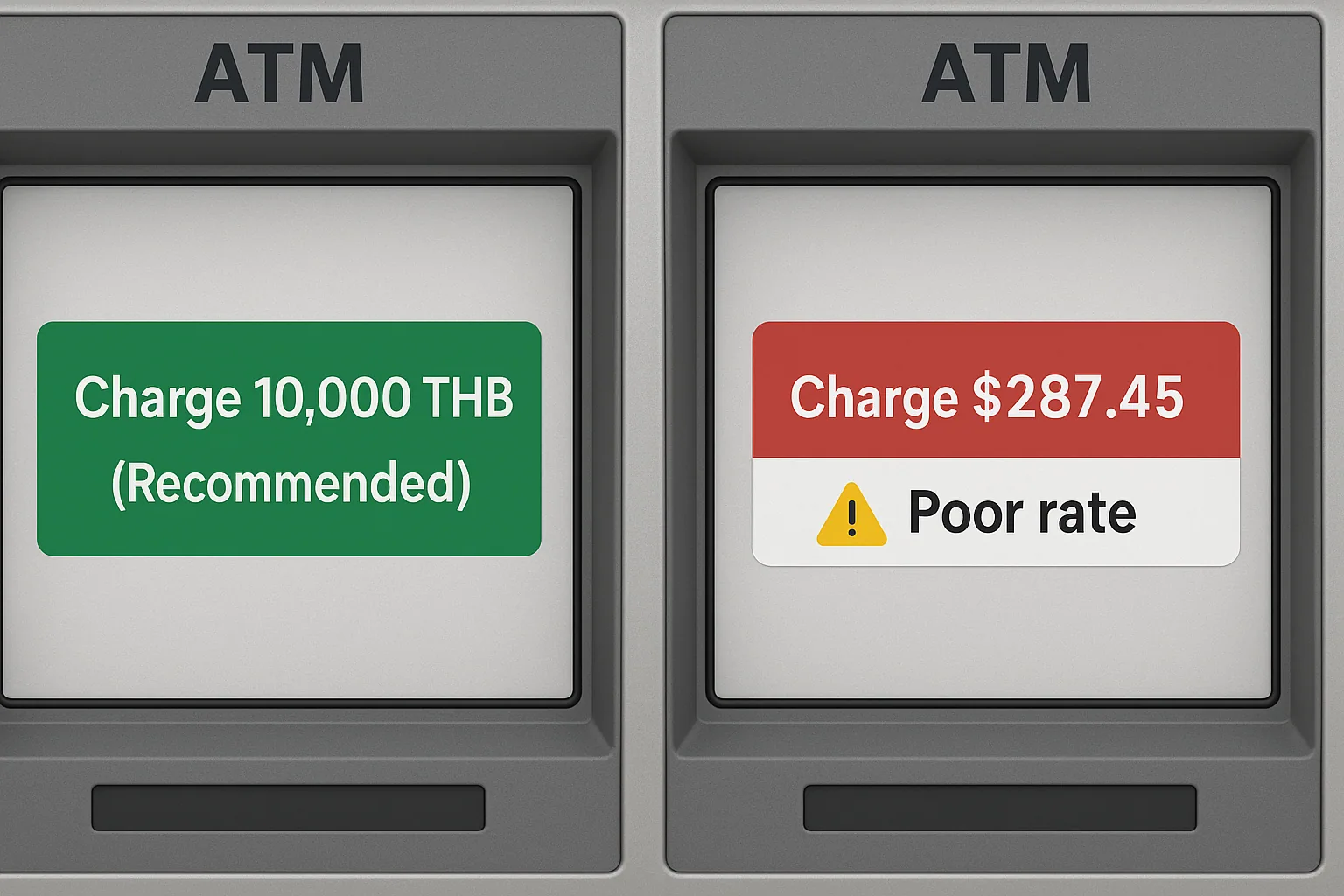

Pulling ฿20,000 (~$560) with a foreign card typically burns around $29 in fees—roughly 5%. Smaller withdrawals hurt more because the flat ฿250 becomes a larger slice of the pie.

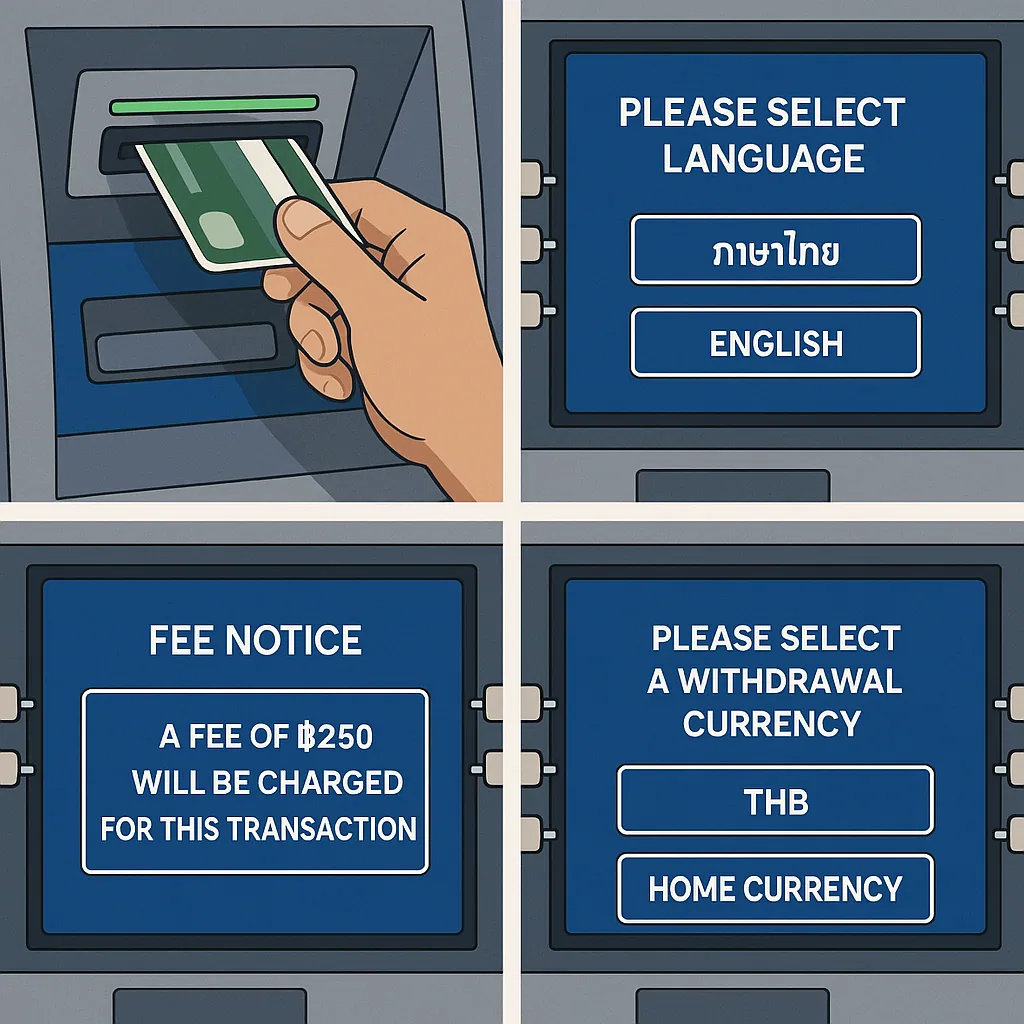

Every Thai ATM follows the same pattern: English button, PIN entry, fee disclosure, and the ever-present “pay in THB or your currency?” teaser.

Short visit? Treat the ฿250 fee as a travel tax, but reduce how often you pay it:

Relying on foreign cards month after month is like walking around with a hole in your pocket. Instead:

Once you’re plugged into PromptPay, QR scans replace most ATM runs—great for safety and for dodging the ฿250 tax.

Always choose the Thai baht option on the right—letting the ATM convert into your currency is where the hidden 5–7% markup lives.

When a Thai ATM offers to bill you in your home currency, it’s upselling DCC. Accepting hands control to the ATM operator, whose rate is typically 5–7% worse than Visa/Mastercard’s. Declining doesn’t cancel the withdrawal; it simply keeps the conversion in your bank’s ecosystem where the FX spread is far slimmer.

Wise: Mid-market FX, transparent fees, two free ATM withdrawals (region-dependent) before a tiny percentage fee kicks in.

Revolut: Near-interbank rates on weekdays, plan-based free ATM allowances, slick budgeting/virtual cards. Weekend FX surcharge applies.

N26: EU-focused but travel-friendly. Premium tiers include worldwide ATM fee waivers riding the Mastercard rate.

Monzo: Fee-free card spend abroad plus fair overseas ATM caps for UK users; minimal fees once you exceed the limit.

Starling Bank: No FX surcharge or ATM fee from the bank’s side, real-time alerts, Mastercard rate—UK address required.

Charles Schwab: Refunds every ATM fee worldwide, no FX markup, and pairs beautifully with Thailand for US travelers (requires brokerage account).

These won’t erase the Thai bank’s ฿250 fee, but they crush your issuer’s surcharge and FX spread, dropping the effective percentage dramatically.

Use indoor, well-lit bank ATMs and keep a hand over the keypad—simple habits that thwart most skimming setups.

Do Thai ATMs accept six-digit PINs?

Many do, but some kiosks are hardwired for four digits. Switch to a 4-digit numeric PIN before you travel so you’re never stuck at the keypad.

Which bank is cheapest for foreign cards?

In 2025, big operators cluster at ฿250, so no single bank is reliably cheaper. Always read the on-screen surcharge in case a bank changes pricing.

How much can I withdraw per transaction?

Krungsri quotes ฿30,000 per pull; others hover around ฿20k–฿25k. Your home bank’s daily limit may be lower, so plan around both caps.

Should I ever accept the ATM’s conversion into my home currency?

Almost never. Declining DCC doesn’t cancel the withdrawal—it simply lets Visa/Mastercard apply their far tighter FX rate. Only override that advice if your bank explicitly tells you their rate is worse (rare).

Got a specific card lineup or withdrawal schedule you’re juggling? Share it and we’ll map out whether an ATM, a fintech card, or a specialist exchanger actually costs less for your exact situation.

Withdraw bigger lumps less often: that same ฿250 hit shrinks dramatically once you pass ฿20k–฿30k per pull.

฿250 fee on ฿10,000 → 2.5%

฿250 fee on ฿20,000 → 1.25%

฿250 fee on ฿30,000 → 0.83%

(Before issuer fees or FX spreads. Withdraw what feels safe to carry.)

Cross-border PromptPay links mean many visitors can now scan Thai QR codes straight from their home banking apps—yet another reason to treat cash as the backup plan.

Tip: use your bank’s ATM locator before you fly—Bangkok Bank, KBank, and Krungsri all publish interactive maps covering malls, airports, and 7‑Elevens nationwide.

Bangkok Bank

1333

Kasikorn Bank

02-888-8888

Siam Commercial Bank

02-777-7777

Krungsri

1572

Krungthai

02-111-1111

24/7 English-language support; keep your passport handy when you call.

See our guides to remittances and currency exchange for the times an ATM simply won’t cut it.